8 Cyclone Metals Limited 2022 – The Challenges of Mining, Exploration, Finance and Politics

By Tim O’Shannassy and Justin Pierce

Acknowledgement

This case study includes material from third party copyright works and we have made all reasonable efforts to: clearly label material where the copyright is owned by a third party; and ensure that the copyright owner has consented to this material being presented in this textbook.

Background

Mining, entertainment and sport entrepreneur and Cyclone Metals Limited Executive Director Tony Sage has a successful track record in scouring the globe for distressed mining assets, improving those assets and then selling them for a profit.

Sage has more than 30 years of experience in corporate advisory, capital raising and funds management. His career highlights include the sale of the “Cape Lambert” magnetite project to Metallurgical Corp of China for $400 million. Cape Lambert Resources Limited changed its name to Cyclone Metals Limited in October 2020 (Cape Lambert Resources Limited, 2020). He is the owner of Perth Glory in the A-League (Ker and Spooner, 2012).

Sage’s business interests include a number of stock exchange listed and private companies with many of these companies holding stakes in each other (Ker and Spooner, 2012). Cyclone Metals Limited, formerly Cape Lambert Limited, could be Sage’s next big mining industry play – or it may go into administration if its balance sheet and liquidity problems are not resolved. The situation is delicately poised evidenced by problems in Sierra Leone mine exploration and development, a plummeting share price, problems with the Australian Stock Exchange (ASX), and a share price well off its peak in the AU$0.60 cents range in 2011 (ASX, 2021).

Fluctuations in share price are a common occurrence with exploratory mining companies, with share prices soaring on good news and sinking on bad news. There are many exploratory mining companies on the ASX with some enjoying success and becoming the next big thing in Australian industry, and many falling by the wayside. This highlights the importance for mine explorers of locating quality mining projects, establishing project finance (debt and/or equity), establishing mining operations and generating core cash flow from operations to underpin the firm share price and provide a return to financiers.

Cyclone Metals Limited now has interests in exploration and mining companies with exposure to gold, iron ore, rare earths, uranium, copper, lithium, lead, silver and zinc in Australia and offshore in Africa, South America and Europe. The future of Cyclone Metals Limited is delicately poised after its recent trading reinstatement on the ASX 3 August 2021 (Cyclone Metals Limited, 2021a). What will be Sage’s next strategy moves?

An Uncertain Business Environment

The global coronavirus pandemic brought with it fresh political tensions to an already colourful national agenda. Where Australia had, for a time, been viewed as politically unstable with its frequent changes in Prime Ministers (Perrigo, 2018), the Federal and State governments’ responses to the coronavirus pandemic polarised the political divide further than it already was (Gao, 2021; Molloy, 2018). State Premiers attempted to dodge criticism by pointing fingers at the Federal government (Kenny, 2021), which languished in the throes of its own sexual abuse scandals (Mao, 2021). Initially, Prime Minister Scott Morrison and Health Minister Greg Hunt secured the rights to locally manufacture the AstraZeneca vaccine (Dalzell, 2020), which quickly fell out of vogue with a flurry of media-fuelled misinformation, hysteria and panic surrounding blood-clotting concerns (Hull, 2021).

Meanwhile, State government-enforced lockdowns and other restrictions to personal freedoms constrained economic activity. Large businesses were able to absorb the downturn whereas small-tomedium enterprises (SMEs)—particularly those in hospitality and entertainment—faced the unenviable decision to close and to furlough employees (Weber, 2020; Speers, 2021). Consequently, many Australians were without work, leaning on the Australian government’s JobKeeper and JobSeeker economic stimuli (Coates & Nolan, 2020). Despite the initial economic shock and media flurry, Australian economic indicators remain among the strongest in the Western world. Table 1 below illustrates the major economic indicators as of November 2021.

Table 1: Australia’s Major Economic Indicators – November 2021 (Reserve Bank of Australia, 2021)

| Indicator | December 2021 Measure |

| Cash Rate | 0.1% |

| Economic Growth | 9.6% |

| Inflation | 3.0% |

| Unemployment | 4.6% |

| Employment Growth | 2.4% |

| Wage Growth | 1.7% |

| Household Saving Ratio | 9.7% |

| Average Weekly Earnings | $1,305.80 |

| Net Foreign Liabilities / GDP | 44.5% |

| AUD / USD | $0.74 |

Australia’s great toll poppy syndrome (Shapiro, 2021) grew out of its egalitarianism, but it is not a predisposition unique to Australia. Through their egalitarianism Australians demand and pay equal respect to everyone, and there are no castes; if you are waiting in line and the Prime Minister comes along, he or she cannot push in front of you! Australians also cannot stand a bludger, defined as a lazy person in work (Australian National University, 2017), which is a testament to the Australian work ethic. With these broad characteristics, Australians reacted to imposed lockdowns with these aspects to emerge as one of the most resilient people—especially Victorians, who endured a total of 267 days locked down (Boaz, 2021). Lockdowns fundamentally changed the fabric of our society with homeschooling, working-from-home, and home-cooking becoming widespread trends (Australian Bureau of Statistics, 2021).

Automation, artificial intelligence, machine learning and the Internet of things continue to dominate advances in technology both in terms of development and adoption (Eckert, Loop, Berlin, Strott, Wendin, Bissell, Open & Lasko, 2017). These are at the cutting edge of technological endeavour and engender a sense that the singularity is coming (Pandya, 2019). The proliferation of social media has irreversibly penetrated the social fabric, but this tethering is a social concern rather than a technological one (Schroeder, 2016; Hurley, 2019). These technologies are built on top of swipe interfaces, advances in the miniaturisation and digitisation of cameras, and steady increases in data transfer speeds (Bogea & Zamith Brito, 2018). With these advancements, however, come increasing threats to information security (Pierce, Jones & Warren, 2006) and firms in all industries must be on guard against these threats.

Australia’s land mass is 7.692 million km2, accounting for less than 5% of the world’s land area and is rich in natural resources (Geoscience Australia, 2021). Considered to engender a ‘harsh’ environment, Australia weathers extremes of nature, enduring heat comparable to the Sahara and cold comparable to the UK (cf. Richards, 2016; McCarthy, 2016). The deserts that consume most of Australia’s land base push inhabitation toward coastal areas, where multiculturalism and cosmopolitanism abound (Bongiorno, 2015). Australia’s little rainfall results in drought, which propels water conservation efforts, and soil salinity and acidification are ongoing concerns for agriculture producers (State of the Environment, 2016). The Indian Ocean dipole, and El-Niño and La-Niña Southern Oscillations buoy periods of cyclonic activity in the tropics and, when combined with the Roaring 40s—that squeeze air between Antarctica and Argentina—make southern Australia feel as cold as Norway (Department of Agriculture, Water and the Environment, 2019).

A constitutional monarchy, Australia is headed by HM Queen Elizabeth, II, whose executive powers are largely ceremonial and delegated to the Governor-General. Australia is also a federation of states, which means that legal power is distributed according to the Constitution. The High Court is the highest power, effectively meaning the regent’s role is purely ceremonial (Parliament of Australia, n.d.). Since the 1970s, Australia has set about increasing the role of the free market and its policy and legal environment focuses on ensuring the liberalisation of markets. It means that non-criminal legal activity in Australia tends to focus on consumer protection (Murtough, Pearson & Wreford, 1998).

The Industry Context

The Australian mining industry is capital intensive with world class rivals that include Rio Tinto Limited, BHP Group Limited, Fortescue Metals Group Limited, Hancock Prospecting Pty Ltd all investing significantly and delivering strong financial results. Vale SA has the scale of iron ore operations to be a viable competitor. Notable on the ASX are a number of smaller more speculative mining stocks such as Cyclone Metals Limited and Cauldron Energy Limited which are a characteristic of the Australian economy.

To continue to operate in the industry requires licenses, investments in safety and, of course, a trained and competent workforce, which is heavily unionised. Many of the great industry competitors have been buoyed by share capital and a track record of strong cash flow generation facilitating regular dividends (Fortescue Metals Limited, 2019).

Traditionally, China was the world’s largest iron ore customer and because of its enormous production of iron ore, Australia’s largest trading partner as a result. There are other nations that have natural resources (e.g., Africa, South American countries) but a limited number of producers that each have significant market power and a financial system and supporting government agencies that will facilitate development. However, iron ore and other natural resources are commodities, which means that buyers must pay the ‘market price.’ China’s interest in iron ore resources in Africa has led some Australian miners to take an interest in countries including Sierra Leone and Guinea though this does come with political and legal risk associated with corruption, war, and human rights (Ker, 2021).

Suppliers to the Australian mining industry are connected to the local communities in which incumbents operate. For example, the Olympic Dam mine in South Australia was set up by BHP Limited, and includes infrastructure owned by BHP Limited but serviced by a number of subcontractors. The labour for these mines is unionised but highly skilled, operating in a fly-in-fly-out mode. It means the locations are often undesirable living locations and must include suitable infrastructure including grocery, medical, beauty, fitness, and other amenities (Fortescue Metals Limited, 2019).

Natural resources such as iron ore, aluminium, copper, and even petrochemicals are very difficult to substitute. These materials are used in construction, technology, automobiles, and many other products needed by modern civilisation. A substitute material being trialled in automobiles is carbon fibre, which, apart from being much lighter than steel, is proving to be much stronger and easier to work with in its production (Aston Martin Lagonda Global Holdings plc, 2021).

Critical success factors required for survival in the mining industry include exploration, mining services, workforce, community engagement, occupational health and safety, transport, transport technology, network alliances, distribution channels, mining engineering, and research and development.

Challenges Mount for Cyclone Metals Limited

Tony Sage the Executive Director at Cyclone Metals Limited has made a fortune taking a financial interest in underperforming mining assets, improving the value of those assets, and selling for a profit. He is supported by two non-executive directors and Company Secretary Melissa Chapman.

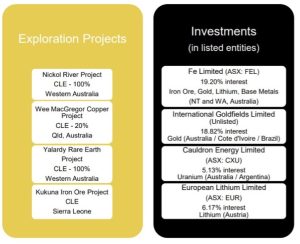

Cyclone Metals Limited Group Structure is provided in Figure 1 below (Cyclone Metals Limited, 2021, p3.). Cyclone Metals Limited has a range of exploration projects and investments in listed and unlisted entities, with three exploration projects on the Australian mainland and one in Sierra Leone. The investor relations web sites of listed entities Fe Limited, Cauldron Energy Limited and European Lithium Limited can be viewed on their respective web sites.

Figure 1: Cyclone Metals Limited Group Structure (Cyclone Metals Limited, 2021a, p3.). Copyright Cyclone Metals Limited. Used with permission.

The Nickol River Project preliminary data report shows several areas of interest that will benefit from test pits to better understand the geology. A Program of Work is in development looking at bedrock structures and alluvial/eluvial gold (Cyclone Metals Limited, 2021b).

The Yalardy Rare Earth Project near Shark Bay in Western Australia is showing potential for a buried diatreme with potential of a number of rare earth possibilities. Further works will be undertaken to better understand prospects (Cyclone Metals Limited, 2021a).

Cyclone Metals Limited wholly owned subsidiary Mining International Pty Ltd (Mining International) holds four mining leases covering 5.3 km2 at the Wee MacGregor Project 40 km southeast of Mount Isa, Queensland. These tenements located in the Kalkadoon Leichhardt Belt have potential for deposits in copper and gold. Cohiba Minerals Limited enjoys a Farm-in agreement with Mining International Pty Ltd for three mining licences here – ML 2540, ML 2773 and ML90098 (Cyclone Metals Limited, 2021a).

There is tremendous demand for iron ore globally, and also demand for other metals such as copper and commodities including diamonds. Countries including China are interested in geographically diversifying their iron ore supply chain away from Australia and showing particular interest in the African continent and South America.

The Cyclone Metals Limited foray into Sierra Leone has not gone well, with the business experiencing some difficult moments (Cape Lambert Resources Limited, 2020).

Cyclone Metals Limited have an interest in the Marampa Project in Sierra Leone, West Africa. The mine which is in the development stage is situated 90 kilometres (km) from the capital, largest city and major Atlantic Ocean port Freetown. The mining licence granted in 2014 (ML05/2014) covers 97.04 km2 and the exploration licence (EL46A/2011) covers 145.86 km2. Cyclone Metals Limited has spent US$62.7 million on exploration and development (Cyclone Metals Limited). In September 2018 the Sierra Leone Government formally advised Marampa Iron Ore (SL) Limited of the cancellation of the mining licence. Marampa Iron Ore (SL) Limited is a wholly owned subsidiary of Cyclone Metals Limited. Subsequently Marampa Iron Ore (SL) Limited commenced legal action against the SLMOM but has subsequently decided to place this legal action on hold. Marampa Iron Ore (SL) Limited does not currently hold tenure over ML05/2014 (Cape Lambert Resources Limited, 2020). Dialogue continues with SLMOM in relation to reinstatement of licence ML05/2014 and Cyclone Metals Limited remains committed to development of the project. The status of the exploratory licence EL46A/2011 also remains in question with no update provided by the SLMOM. Marampa SL has not paid renewal fees of the exploratory licence since 2017. Due to these ongoing uncertainties the value of the Marampa Project was fully impaired in the accounts dated 30 June 2016, and the value of these assets remain fully impaired. Cyclone Metals Limited are currently committing minimum expenditure on the Marampa Project (Cape Lambert Resources Limited, 2020).

Cyclone Metals Limited also has an interest in the Kukuna Project with an exploratory licence covering 68 km2. The licence area is 120 km northeast of Freetown and 70 km north of Marampa. This project is under care and maintenance (Cape Lambert Resources Limited, 2020).

The project difficulties and then the financial impairment on the Marampa Project were critical moments for Cyclone Metals Limited with the share price on the ASX subsequently plummeting. Further difficulties led to the moment in October 2020 when the company’s shares were delisted from the ASX, but in August 2021 they were reinstated after releasing a full form prospectus (Cyclone Metals Limited, 2021a). In September 2021 245,000,000 shares were issued at a price of AU$0.005 per share raising AU$1,225,000. These funds have been directed to the Nickol River Project (Cyclone Metals Limited, 2021a).

Cyclone Metals Limited has further interests on the African continent in the Democratic Republic of Congo with the Kipushi Cobalt Copper Tailings Project which comprises a tailing dam at PE12347 and the Kipushi Processing Plant at mining licence PE481 (Kipushi Project) (Cape Lambert Resources Limited, 2019). The Kipushi Project is 25 km from the Democratic Republic of Congo’s second largest city Lubumbashi. Cyclone Metals Limited engaged in a 50/50 joint venture with Paragon Mining SARL (Paragon) to develop the Kipushi Project with La Patience SPRL (Patience). However this project was unable to receive project funding and the joint venture agreement with Paragon is now terminated (Cape Lambert Resources Limited, 2020).

Table 2 below evidences the weak financial position of Cyclone Metals Limited with a particularly poor net equity position. The major portion of financial debt is current, which may be a cause for concern.

Table 2 : Cyclone Metals Limited Summary Financial Highlights (Cape Lambert Resources Limited, 2020)

|

Balance Sheet Highlights |

2019 $ | 2020 $ |

% Change |

| Total Current Assets | 447,218 | 544,027 | |

| Total Non-Current Assets | 7,204.352 | 6,019,543 | |

| Total Assets | 7,651,570 | 6,563,570 | -14% |

| Total Current Liabilities | 7,067,496 | 6,767,491 | |

| Total Non-Current Liabilities | 3,551,627 | 1,370,504 | |

| Total Liabilities | 10,619,123 | 8,137,995 | -23% |

| Net Liabilities | (2,967,553) | (1,574,425) | 47% |

| Equity | (2,967,553) | (1,574,425) | 47% |

| Financial Debt | |||

| Convertible note (current) | 459,737 | 206,773 | |

| Convertible note (non-current) | – | 69,343 | |

| Short term loan payable | 733,001 | 2,200,000 | |

| Long term loan payable | 689,734 | – | |

| Profit and Loss Statement Highlights | |||

| Revenue items: | |||

| Revenue | 278,746 | 324,910 | |

| Gain on extinguishment of liability | – | 787,568 | |

| Other income | 79,316 | 2,522,638 | |

| Notable expense items: | |||

| Finance expenses | (132,949) | (1,673,840) | |

| Impairment of investment in associate | (718,723) | (2,991,912) | |

| Impairment/reversal of impairment in joint venture | (3,383,317) | 57,849 | |

| Share of net profits/(losses) of associates accounted for using the equity method |

(919,462) |

1,430,813 |

|

| Share of net losses of joint venture accounted for using the equity method |

(1,006,302) |

– | |

| Net loss for the year | (6,549,163) | (1,534,482) | 77% |

| Basic loss per share (cents per share) | (0.64) | (0.13) |

Cyclone Metals Limited reported another though smaller financial loss in 2020 compared with the previous year; finance expenses jumped significantly in 2020. These overall poor financial results are reflected in the weak share price.

The Future Strategy for Cyclone Metals Limited

There are complex international strategy matters at play here for Cyclone Metals Limited, with a range of onshore Australian projects, strategic shareholdings in other ASX listed miners, and very sensitive negotiations with the Sierra Leone Government ongoing. The industry context is fast evolving with China’s appetite for iron ore a potential rich source of cash flow for mining companies with access to the right mine tenements in the right countries and the resources for development. Cyclone Metals Limited financial situation is precarious. Sage needs a win!

There are a range of strategy issues and challenges for Sage to consider. Which subsidiary and/or which project should benefit from the available equity and debt finance? How can Cyclone Metals Limited strengthen its financial position? Which project will be Cyclone Metals Limited next success? Does Cyclone Metals Limited have the available time and resources to develop the next successful mining venture? What is Cyclone Metals Limited’s interest in helping indigenous communities and indigenous opportunity? Should Cyclone Metals Limited focus its attention on exploration and development of Australian mine resources only? What value are these strategic shareholdings in other listed Australian miners? Should Cyclone Metals Limited continue to do business in Sierra Leone? Should Cyclone Metals continue to do business in the Democratic Republic of Congo? Which are the highest priority issues needing attention in the next one to two years?

References

Aston Martin Lagonda Global Holdings plc, 2021. Annual Report, https://amsc-prodcd.azureedge.net/-/media/corporate/documents/annual-reports/aston-martin-lagonda-2020annual-report-v2.pdf?rev=c521fa0bba7841569b5c22bb45c14daa, viewed 14 December 2021.

Australian Bureau of Statistics, 2021. Household Impacts of COVID-19 [sic.] Survey, 14 July 2021, https://www.abs.gov.au/statistics/people/people-and-communities/household-impacts-covid-19survey/latest-release, viewed 9 December 2021.

Australian National University, School of Literature, Languages & Linguistics, 2017. Meaning and Origin of Australian Words and Idioms, 19 October 2017, https://slll.cass.anu.edu.au/centres/andc/meanings-origins/all, viewed 8 December 2021.

Australian Stock Exchange, 2021. Cyclone Metals Limited https://www2.asx.com.au/markets/company/cle, viewed 12 December 2021.

Bogea, F. & Zamith Brito, E.P., 2018. Determinants of Social Media Adoption by Large Companies, Journal of Technology Management & Innovation, 13(1), http://dx.doi.org/10.4067/S071827242018000100011, viewed 12 December 2021.

Boaz, J., 2021. Melbourne Passes Buenos Aires’ World Record for Time Spent in COVID-19 [sic.] Lockdown, ABC News, 3 October 2021, https://www.abc.net.au/news/2021-10-03/melbournelongest-lockdown/100510710, viewed 9 December 2021.

Bongiorno, F., 2015. How Australia Learned to be Cosmopolitan, The Guardian, 30 October 2015, https://www.theguardian.com/australia-news/australia-culture-blog/2015/oct/30/how-australialearned-to-be-cosmopolitan, viewed 25 October 2021.

Business News, 2021. Tony Sage, https://www.businessnews.com.au/Person/Tony-Sage, viewed 12 December 2021.

Cape Lambert Resources Limited, 2020. Annual Report, https://cyclonemetals.com/wpcontent/uploads/2020/11/200930-Annual-Report-2020.pdf

Coates, B. & Nolan, J., 2020. How to Get both JobKeeper and JobSeeker, The Conversation, 22 July 2020, https://theconversation.com/how-to-get-both-jobkeeper-and-jobseeker-143109, viewed 8 December 2021.

Cape Lambert Resources Limited, 2021. Presentation and Fact Sheet, https://cyclonemetals.com/presentation-and-factsheet/, viewed 12 December 2021.

Cyclone Metals Limited, 2021a. Quarterly Report, 30 September 2021, https://wcsecure.weblink.com.au/pdf/CLE/02444370.pdf, viewed 12 December 2021.

Cyclone Metals Limited, 2021b. Nickol River Project Update, https://wcsecure.weblink.com.au/pdf/CLE/02455118.pdf, viewed 22 November 2021

Dalzell, S., 2020. Australia Locks in Coronavirus Vaccine Deal to Produce Oxford UniversityAstraZeneca Candidate if Approved, ABC News, 18 August 2020, https://www.abc.net.au/news/2020-08-18/australia-locks-in-oxford-astrazeneca-coronavirusvaccine-deal/12571454, viewed 7 December 2021.

Department of Agriculture, Water and the Environment, 2019. Wind Chill, 6 June 2019, https://www.antarctica.gov.au/about-antarctica/weather-and-climate/weather/wind-chill/, viewed 14 June 2021.

Eckert, V.H., Loop, P., Berlin, B., Strott, E., Wendin, C, Bissell, K., Openn, F. & Lasko, R. 2017. The Essential Eight Technologies Board Byte: Artificial Intelligence, PricewaterhouseCoopers Governance Insights Center, December 2017, https://www.pwc.com.au/pdf/essential-8-emerging-technologiesartificial-intelligence.pdf, viewed 9 December 2021.

Fortescue Metals Group Limited, 2019. Annual Report, Perth, Western Australia, https://www.fmgl.com.au/docs/default-source/annual-reporting-suite/fy19-annual-report.pdf., viewed 12 December 2021.

Gao, M., 2021. COVID-19 [sic.] and Political Polarization [sic.]: Notes on Australia’s Chinese Communities, PORTAL Journal of Multidisciplinary Studies, 17(1/2), pp. 97-103.

Geoscience Australia, 2021. Australia’s Size Compared, https://www.ga.gov.au/scientifictopics/national-location-information/dimensions/australias-size/compared, viewed 21 October 2021.

Hull, C., 2021. Australia’s Covid [sic.] Risk is Far Greater than Blood Clot Vaccine Hysteria, The Canberra Times, 1 May 2021, https://www.canberratimes.com.au/story/7231881/australias-covidrisk-is-far-greater-than-blood-clot-vaccine-hysteria/, viewed 7 December 2021.

Hurley, Z., 2019. Why I No Longer Believe Social Media is Cool…, Social Media + Society, 5(3), https://doi.org/10.1177%2F2056305119849495, viewed 12 December 2021.

Kenny, M., 2021. Democracy Sausage: Finger Pointing, Federalism and Alternative Facts, Australian Studies Institute, 6 July 2021, https://ausi.anu.edu.au/news/latest-democracy-sausage-episodefinger-pointing-federalism-and-alternative-facts, viewed 7 December 2021.

Ker, P., 2021. Australian miners brace for fallout after Guinea coup, Australian Financial Review, 9 July 2021, p. 14.

Ker, P. & Spooner, R. 2012. No glory for Sage after police raids, Sydney Morning Herald, 21 December, https://www.smh.com.au/business/no-glory-for-sage-after-police-raids-201212202bpiy.html, viewed 12 December 2021.

Mao, F., 2021. How Rape Allegations have Rocked Australian Politics, BBC News, 2 March 2021, https://www.bbc.com/news/world-australia-56178290, viewed 7 December 2021.

McCarthy, A., 2016. Colourful Climate Comparison Maps Show Surprising Similarities Between Countries, Lonely Planet, 5 July 2016, https://www.lonelyplanet.com/articles/climate-maps-worldweather-australia, viewed 10 December 2021.

Molloy, S., 2018. Australia has never been more divided on social and political issues. Are we becoming the US?, News.com.au, 12 October 2018, https://www.news.com.au/finance/work/leaders/australia-has-never-been-more-divided-on-socialand-political-issues-are-we-becoming-the-us/news-story/0891d42f4ce4e23c92aba59769ab60e9, viewed 7 December 2021.

Murtough, G., Pearson, K. & Wreford, P., 1998. Trade Liberalisation and Earnings Distribution in Australia, Productivity Commission: Industry Commission Staff Research Paper, February 1998, https://www.pc.gov.au/research/supporting/trade-liberalisation/tradelib.pdf, viewed 14 June 2021.

Pandya, J., 2019. The Troubling Trajectory of Technological Singularity, Forbes, 10 February 2019, https://www.forbes.com/sites/cognitiveworld/2019/02/10/the-troubling-trajectory-oftechnological-singularity/?sh=695050526711, viewed 10 December 2021.

Parliament of Australia, n.d., Infosheet 20: The Australian System of Government, https://www.aph.gov.au/About_Parliament/House_of_Representatives/Powers_practice_and_proc edure/00_-_Infosheet_20_-_The_Australian_system_of_government, viewed 14 June 2021.

Perrigo, B., 2018. Why Does Australia Keep Getting Rid of Its Prime Ministers?, Time, 24 August 2018, https://time.com/5377190/why-australia-changes-prime-ministers/, viewed 7 December 2021.

Pierce, J.D, Jones, A.G. & Warren, M.J., 2006. Penetration Testing Professional Ethics: A Conceptual Model and Taxonomy, Australasian Journal of Information Systems, 13(2), pp. 192-200.

Reserve Bank of Australia, 2021. Key Economic Indicators Snapshot, 5 November 2021, https://www.rba.gov.au/snapshots/economy-indicators-snapshot/, viewed 8 December 2021.

Richards, J., 2016. Australia’s 10 Deserts, Australian Geographic, 20 April 2016, https://www.australiangeographic.com.au/topics/science-environment/2016/04/australias-10deserts/, viewed 10 December 2021.

Schroeder, R., 2016. The Globalization [sic.] of On-Screen Sociability: Social Media and Tethered Togetherness, International Journal of Communication, 10(1), pp. 5626-43.

Shapiro, J., 2021. Why the Tall Poppy Syndrome Cuts Both Ways, Australian Financial Review, 29 April 2021 [online] https://www.afr.com/markets/equity-markets/tall-poppy-syndrome-is-it-real-orimagined-in-australian-finance-20210428-p57n63, viewed 8 December 2021.

Speers, D., 2021. The Cost of Climate and COVID [sic.], Q+A (ABC), 12 August 2021, https://www.abc.net.au/qanda/2021-12-08/13489378, viewed 7 December 2021.

State of the Environment, 2016. Soil: Salinity & Acidification, Department of Environment, 2016, https://soe.environment.gov.au/theme/land/topic/2016/soil-salinity-and-acidification, viewed 10 December 2021.

Weber, L., 2020. During Coronavirus Crisis, Big Company Display Largess—But for How Long?, Wall Street Journal, 22 March 2020, https://www.wsj.com/articles/during-coronavirus-crisis-bigcompanies-display-largessbut-for-how-long-11584893891, viewed 7 December 2021.